What Is a Financial Aid Offer?

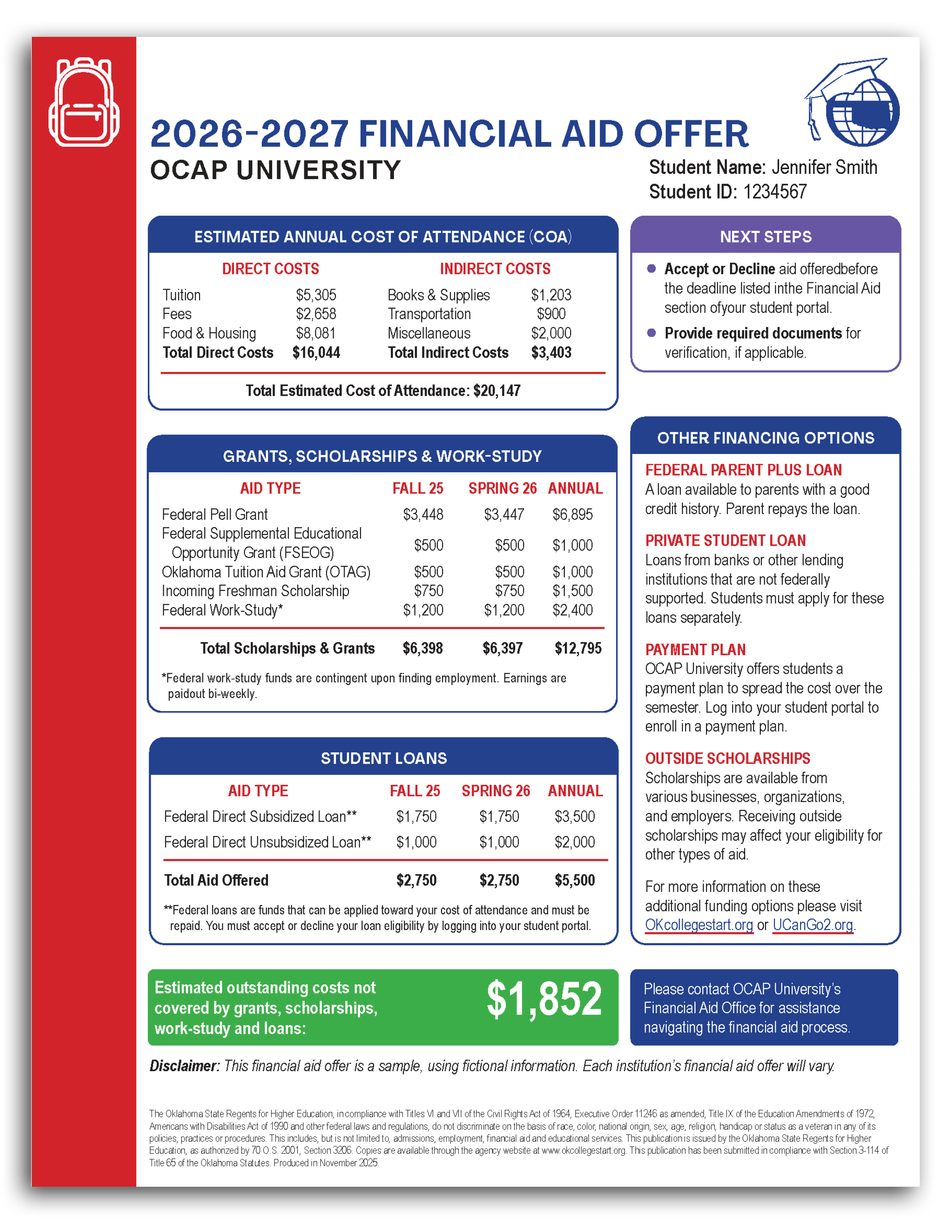

When you apply for financial aid to help cover the educational

expenses at the college you're considering, the financial aid

office at the institution will let you know what you're eligible to

receive. The college will send you a financial aid offer that shows

your estimated eligibility for federal and state aid programs.

Remember to read your offer carefully and weigh all of your options

.

*Note: Food and housing estimates are based

on a student living in a traditional dormitory with a roommate and

participating in a 20-meal-per-week plan. Many institutions offer a

wide variety of food and housing plans, and costs may differ from

the average reported above.

What is Cost of Attendance?

Cost of Attendance is the estimated total cost of attending a

college for one year. This amount includes tuition, fees, food and

housing, books, supplies and travel expenses. The amount of your

federal aid can't be greater than your total cost of

attendance.

Visit the

Student Loans page to learn more.